Our unique portfolio management tool AlphaScope® is engineered to focus your attention on the areas of your portfolio where the most alpha can be gained or lost, guiding your actions to enhance outperformance. AlphaScope’s iterative process will uncover the most relevant, objective recommendations for your portfolio. In a weekly report to you, we provide personalized portfolio recommendations to add, increase, or decrease holdings based on an objective analysis of your investment history.

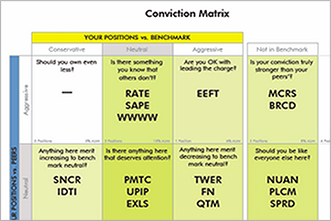

Using collaborative filtering combined with a profile-based scoring system, AlphaScope surfaces relevant, timely, and insightful recommendations by comparing your actual holdings with the holdings of thousands of similar, actively-managed funds as well as your benchmark. Our detailed report graphically illustrates where your weighting varies most from your peers and benchmark, allowing you to focus in on the areas that will most improve performance.

How do we work with you to maximize your portfolio’s alpha?

“My clients are looking for an objective view of their portfolio that speaks to each name. I’ll tell clients it’s like a health checkup for your portfolio.”

– Vida Bruozis, Managing Director, Institutional Sales